Are There Any IRS Tax Credits for Making My Home More Energy Efficient?

Yes, IRS tax credits are available to help taxpayers reduce the cost of making a home energy efficient. The Energy Efficient Home Improvement Credit, or EEHIC, program applies to qualifying residential energy improvements between January 1, 2023 and December 31, 2032.

Features of the EEHIC program include:

- No annual lifetime or maximum limit for qualifying energy improvements after 2022. Homeowners can claim the maximum yearly energy tax credit until 2033.

- Tax credit of $1,200 for energy efficiency improvements and expenses.

- Tax credit of $2,000 for qualified boilers, biomass stoves, and heat pumps.

- Individual credit limits for windows ($600) and doors ($250 per door up to $500 total).

- Tax credit of $150 for a residential energy audit.

Property owners who are not living in the home cannot claim the IRS EEHIC credit. Also, homeowners should be aware that energy efficiency credits are nonrefundable.

This means if you owe back taxes, you cannot receive an energy credit worth more than your amount of unpaid taxes.

What Types of Energy-Saving Improvements Qualify for Residential Energy Credit?

The IRS offers two energy credit programs: EEHIC and the Residential Clean Energy Credit. EEHIC offers tax credits to upgrade HVAC systems, doors, and windows.

Other examples of what qualifies for EEHIC include:

- Sealing leaks around doors and windows.

- Adding new insulation to crawlspaces, basements, and attics.

- Replacing old HVAC equipment with energy-efficient equipment.

- Replacing water heaters with high-efficiency water heaters or heat pump water heaters.

The Residential Clean Energy Credit program helps pay for installing renewable energy systems in homes, such as:

- Solar water heaters with Solar Rating Certification.

- Solar panels.

- Small wind turbines (limited to 100 kilowatts).

- Fuel cell property (only for the taxpayer’s primary residence).

- Geothermal heat pumps with Energy Star certification.

How Do You Claim Energy Credit on Your Tax Return?

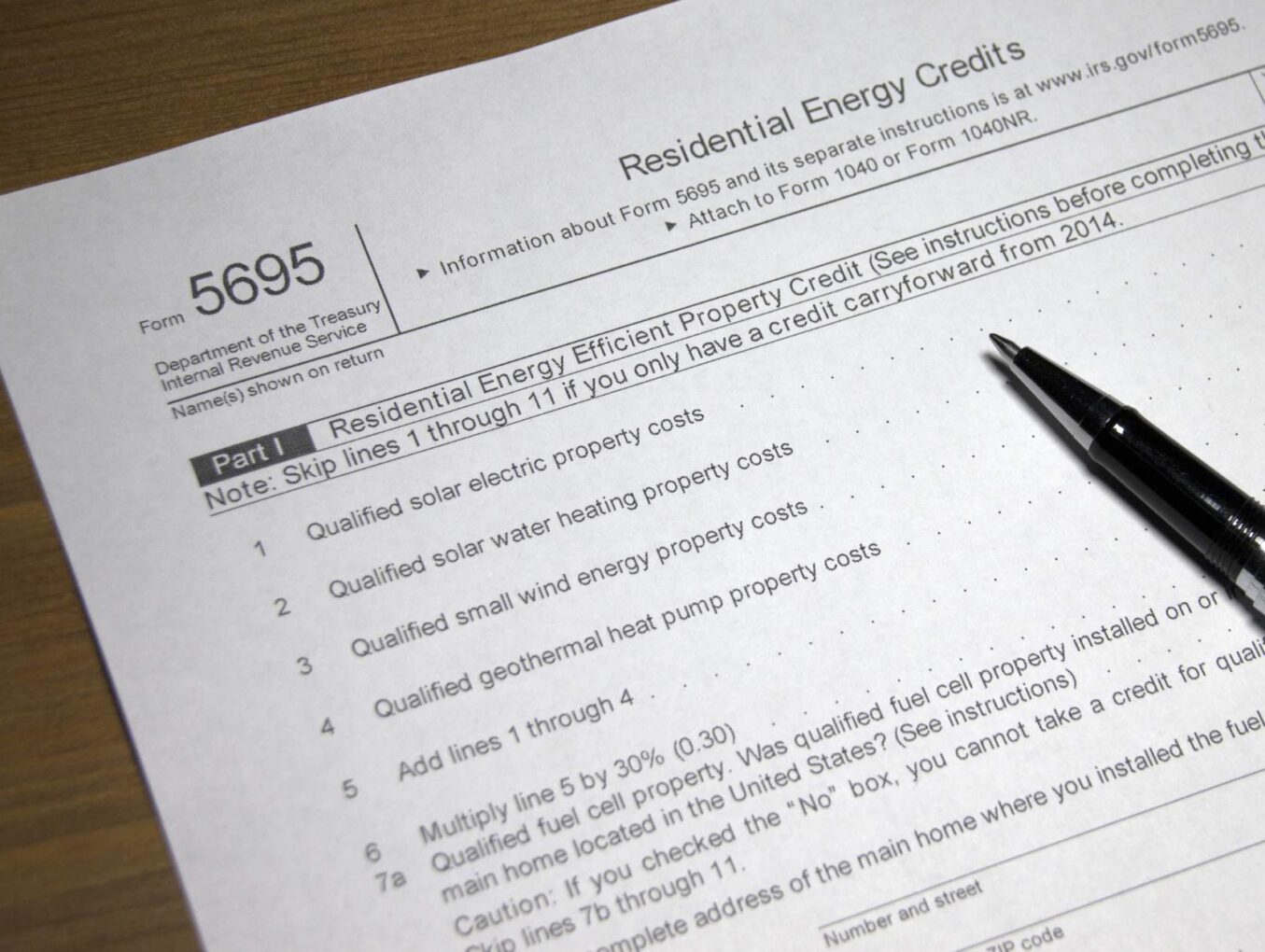

To claim an energy credit taxpayers must file Form 5695.

Follow these steps to complete IRS Form 5695 correctly:

- Gather invoices, receipts, and other documentation that shows qualifying residential energy improvements were made during a specific tax year.

- Determine under which category improvements fall: Energy Efficient Home Improvement Credit or Residential Clean Energy Credit.

- Complete the section on Form 5695 that corresponds to your specific credit category.

- Attach Form 5695 to your IRS tax return and submit both documents.

The deadline to submit 5695 is the same as for filing federal tax returns: April 15, 2024, or October 15, 2024, if an extension is requested.

Does the IRS Limit the Amount of Credit I Can Receive for Home Energy Improvements?

Yes, the IRS does limit the amount of credit you receive for home energy improvements. However, the credit limit amount depends on the year and the improvements made to a primary residence. Generally, the limit is 30% of the total expenses for the specific tax year.

Remember, there is no annual maximum and no lifetime maximum on credits taken until 2033, when the home energy improvement credit programs expire.

Can a Residential Energy Credit Reduce or Eliminate Existing Tax Debt?

A Residential Energy Credit can reduce a tax debt but not eliminate it because this type of IRS credit is considered a nonrefundable tax credit.

For example, you owe $1,500 in back taxes and qualify for a $500 Residential Energy Credit. That energy credit reduces what you owe the IRS to $1,000.

As said before, although energy credits may help lower a person’s tax debt, these credits will never eliminate an existing tax debt. Taxpayers with significant tax debt should explore tax relief options, like an installment agreement or Offer in Compromise, provided by the IRS.

What Happens If the Energy Credit Amount Is More Than What I Owe for Taxes?

Taxpayers can carry over residential energy credits or apply the excess to tax debt. However, if a taxpayer usually receives a refund from the IRS, the carryover option cannot be used until a refund is no longer issued. Also, the amount that can be carried over will depend on the specific type of energy credit.

Where Can I Find More Information About IRS Energy Credits for Homes and Vehicles?

For more information about home energy and clean vehicle tax credits, you can visit the following IRS resources.

Home Energy Tax Credits

Energy Efficient Home Improvement Credit: https://irs.gov/credits-deductions/energy-efficient-home-improvement-credit

FAQs about Energy Efficient Home Improvements and Residential Clean Energy Property Credits (IRS Publication updated April 17, 2024): irs.gov/pub/taxpros/fs-2024-15.pdf

Clean Vehicle Tax Credits

Clean Vehicle Tax Credits: https://irs.gov/clean-vehicle-tax-credits

Credits for New Clean Vehicles Purchased Since 2023: https://irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

Need more help? You can start online by answering 6 simple questions.

6 Simple Questions. Free Evaluation.