Here is a quick guide to what you need to know about NFTs and NFT taxes. Keep in mind that because NFTs are so new, there is still a gray area for NFT taxes and NFT tax rates since the IRS has not officially stated how they treat NFTs.

This information can change very quickly, so always be sure to do your own research.

What Are NFTs?

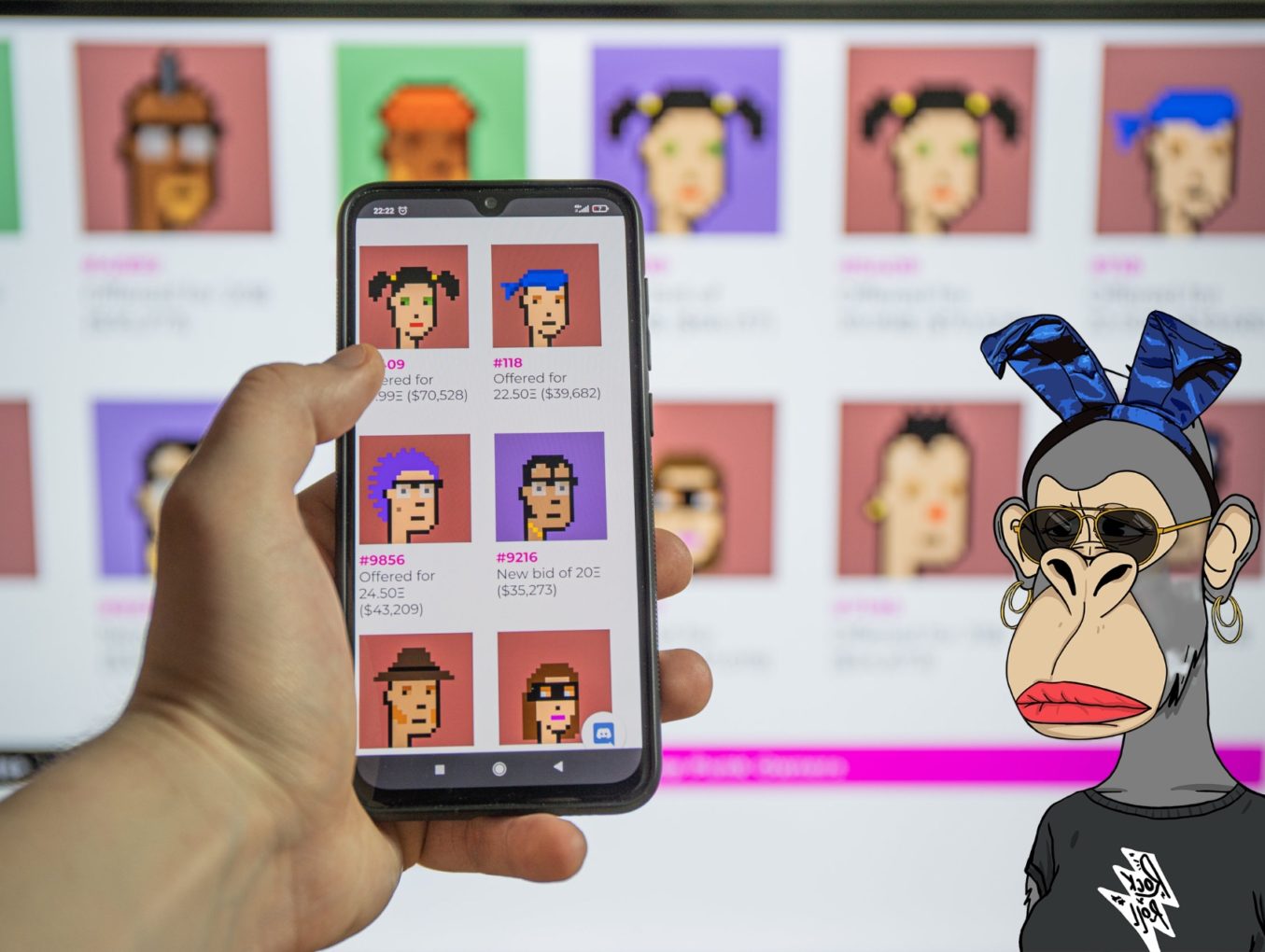

NFT is short for non-fungible token, which is a unique, non-interchangeable digital certificate that allows digital content, such as images, songs and videos, to be bought, sold and traded via blockchain.

Blockchain is an unregulated and decentralized digital ledger where transactions involving cryptocurrencies and other digital assets (including NFTs) are recorded.

Here are some resources where you can learn more about NFTs:

“What is a non-fungible token (NFT)?”

“NFT’s Explained”

Are NFTs Taxable?

Yes, NFTs are taxable by the IRS, just like fungible cryptocurrencies such as Bitcoin. If you make money from selling or trading an NFT, you will owe taxes on your NFT profit.

Does the IRS Classify NFTs As Property?

The rules are still unclear as to whether the IRS classifies NFTs as collectibles or property (assets) since the IRS does not yet have an official stance on NFT taxes.

Back in 2019 the IRS offered some clarification, saying it considers convertible cryptocurrencies to be property. It thus stands to reason that at present, the IRS may consider nonconvertible cryptocurrencies and NFTs as property.

If the IRS taxes NFTs as property (assets) and the NFT is held for more than a year, long-term capital gains tax rates apply up to 20% based on the NFT owner’s income. When an NFT is held for less than a year, short-term capital gains tax rates apply up to 37%.

This is equivalent to ordinary income tax rates. Should the IRS tax NFTs as collectibles in the future, collectibles tax rates would apply up to 28%.

What Are the Taxes for NFT Creators When Selling an NFT?

If you are an NFT creator and sell an NFT you created, the IRS treats the NFT profit as ordinary income, which means you will be taxed according to your income bracket. For the 2021 tax year, ordinary income tax rates range from 10% to 37% depending on income and filing status.

Also, since the profit from an NFT sale is not W-2 income in which your employer pays half your Social Security and Medicare taxes, you must also pay the full amount of these “self-employment taxes” as an NFT creator, which amounts to 15.3%.

What Are the Types of NFT Owners?

There are several different types of NFT owners, and the IRS taxes NFT owners on capital gains.

NFT Investor

An NFT investor is a person or business buying NFTs hoping they will increase in value over time. The IRS taxes NFT investor profits from NFT sales as capital gains, which carry a lower tax rate than ordinary income if the NFT is held for more than a year. In this case, long-term capital gains taxes apply.

NFT Hobbyist

An NFT hobbyist is someone who buys NFTs without regard to their investment value. When an NFT hobbyist makes money from selling an NFT, they are taxed at their ordinary income rate (short-term capital gains taxes) if they hold the NFT less than a year.

NFT Business Collector

An NFT business collector buys NFTs not for resale but to use in the course of running their business. For instance, an NFT business collector might purchase an NFT that gives them the exclusive use of a certain logo or musical playlist. Capital gains taxes apply if the NFT business collector eventually sells the NFTs.

NFT Dealer

NFT dealers buy and sell NFTs as their primary business model, and an NFT dealer is taxed based on short or long-term capital gains for NFT profits they make. An NFT dealer might claim deductions on the expenses involved in carrying out NFT sales.

What Are the Taxes for NFT Owners?

NFT owners are subject to taxes when buying, trading, and selling NFTs. Here is what you need to know about NFT owner taxes:

Buying NFTs

NFTs are bought with cryptocurrencies, which also carry investment value. When you are an NFT owner and dispose of the cryptocurrency for more than you paid for it, you can be taxed on the profit (capital gains).

Trading NFTs

If you are an NFT owner and trade an NFT for another NFT at a gain, you can be taxed on the NFT profit. For example, if an NFT owner buys an NFT for $1,000 and trades it six months later for an NFT worth $2,000, the NFT owner will owe short-term capital gains NFT taxes on the $1,000 gain.

Selling NFTs

When an NFT owner sells an NFT at a gain, the NFT owner owes capital gains taxes on the NFT profit.

Are NFT Airdrops and NFT Giveaways Taxable?

Yes, the IRS can tax NFT airdrops and NFT giveaways. NFT taxes on tokens won in NFT airdrops and giveaways are just like taxes for game show winnings and other prizes.

Do NFT Gas Fees Factor in NFT Capital Gains?

A gas fee is a type of transaction fee paid by an NFT buyer. When you pay a gas fee, it increases your cost of an NFT by the amount of the fee, which lowers your capital gain by the same amount when you sell. However, if your NFT buyer pays the same gas fee, it adds back in to your NFT capital gain.

How Can Wiztax Help?

If you need help navigating this new web3 world, call us at (866) 568-4593 to learn more about exactly what we can do for you.

Or start here to take our free online evaluation.

6 Simple Questions. Free Evaluation.

Join our Newsletter

Enter your email address to join our free newsletter. Get all the latest news and updates.