You can request an IRS Tax Return Transcript from the IRS if you need a copy of last year’s tax return or a return filed in the last 3 years. This transcript comes directly from the IRS and shows the same information as your 1040, including your adjusted gross income (AGI).

Here is what you need to know:

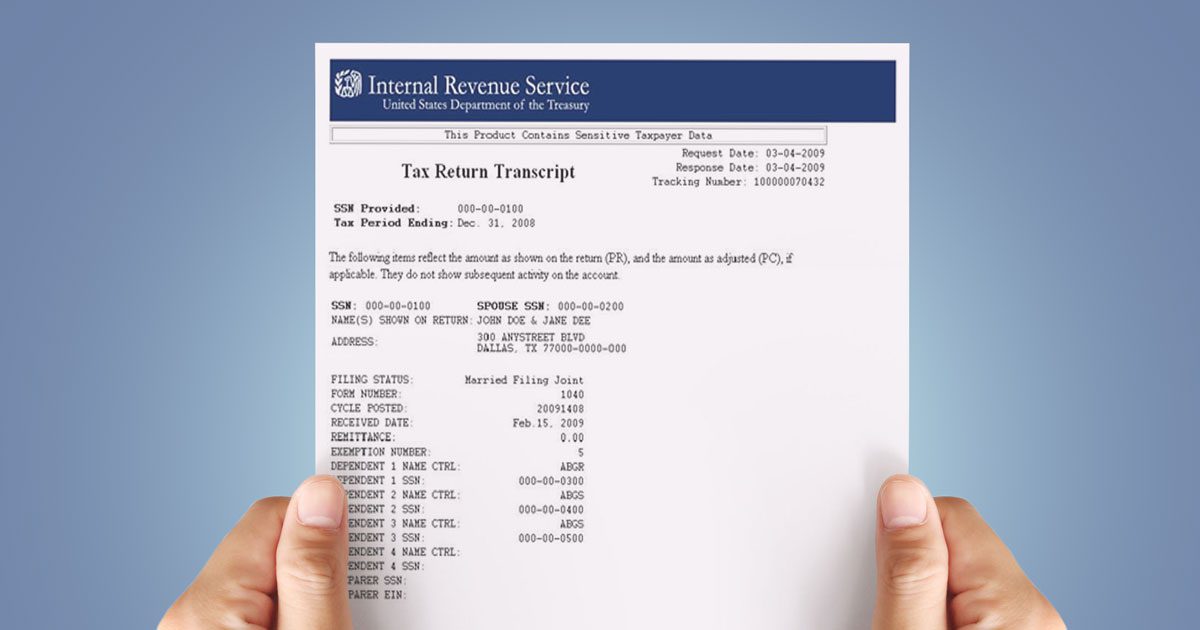

What Is an IRS Tax Return Transcript?

An IRS tax return transcript is a summary of your 1040 return including additional forms and schedules. In fact, you will see many of the same line items from your 1040 also on your tax return transcript. Keep in mind that it does not include changes made after you filed your original return (i.e., you submitted an amended return).

You can get the current year’s tax return transcript or a transcript for a return filed in the last 3 years. Note that if you need an exact copy of your original tax return, you will need to submit Form 4506. You can request actual tax return copies up to 6 years prior with Form 4506. Each tax return copy is $50 and delivered in about 75 days.

What Is It Used For?

An IRS tax return transcript is often used by lenders to verify income and other financial information when you are applying for a home loan or student financial aid. Lenders want to know you can pay off your loan if approved. If you filed an amended return, you may have to provide your tax return transcript plus your signed 1040X.

Also, since the IRS uses your adjusted gross income from the previous year to verify your identity when you e-file, you can find your AGI on your tax return transcript if you do not remember it.

What Information Is Included?

All information from your Form 1040 and for schedules like itemized deductions (Schedule A), profit or loss from business (Schedule C), and capital gains and losses (Schedule D) are included. Remember that a tax return transcript will not include items from your 1040X amended return if you submitted tax return changes.

How Do I Get an IRS Tax Return Transcript Online?

You can request an IRS tax return transcript online in less than 10 minutes by using the IRS Get Transcript tool at https://irs.gov/individuals/get-transcript. If you are creating a new IRS online account, you will also need an ID.me account. For ID.me, you need to verify your identity by uploading an ID card such as your driver’s license and taking a selfie with a smartphone or webcam. If you have an IRS username from the past, you can use that to log in.

Once logged in to Get Transcript, click the tax year under Tax Return Transcript that you would like to view.

How Do I Get an IRS Tax Return Transcript by Mail?

You can request your transcript by mail from the same IRS Get Transcript page. Click the “Get Transcript by Mail” button. Ain addition, you will need the mailing address from your last tax return to complete your tax return transcript by mail request. It will take 5 to 10 days after you submit your request to receive your tax return transcript in the mail.

If you want to request by phone, call the IRS at 800-908-9946. Only the person on the original tax return may make this request.

How Can Wiztax Help?

Call us today at (866) 568-4593 if you need help requesting an IRS tax return transcript.

Or start here to take our free online evaluation.

6 Simple Questions. Free Evaluation.

Join our Newsletter

Enter your email address to join our free newsletter. Get all the latest news and updates.