What Is IRS Form 8919?

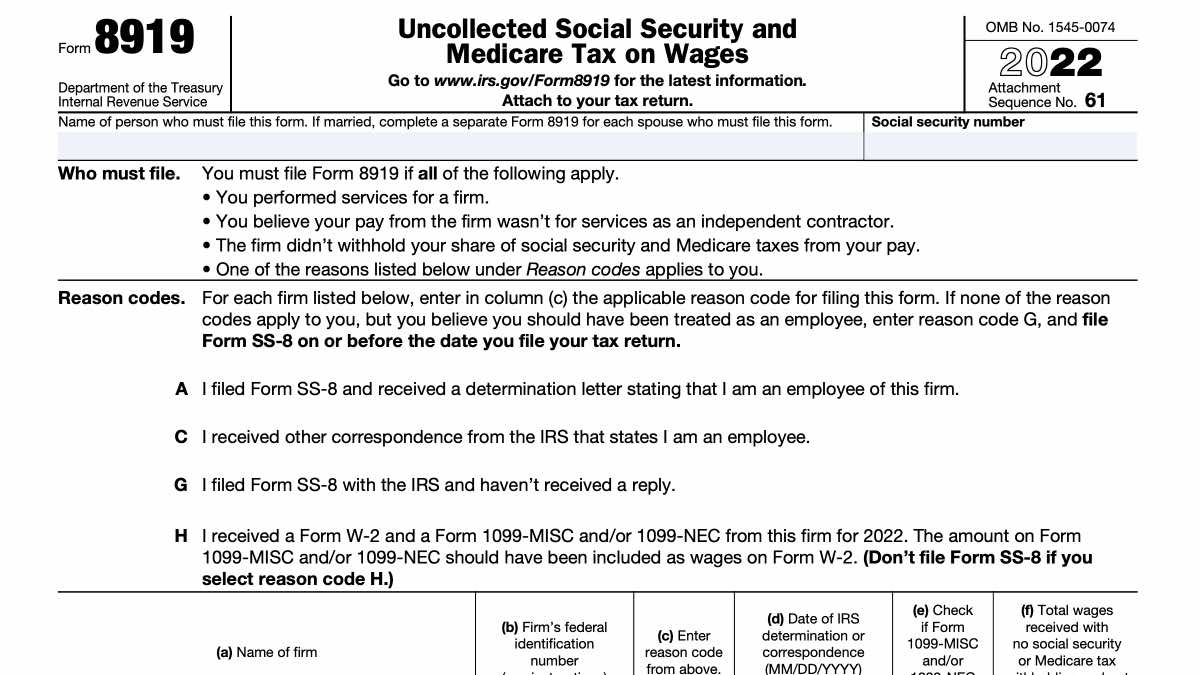

If a company pays you as an independent contractor, but you are an employee, you will need to file IRS Form 8919 for “Uncollected Social Security and Medicare Tax on Wages.”

This form is used to calculate how much Social Security and Medicare taxes should have been withheld from your pay.

Who Must File an 8919 Form?

It can be up to the IRS to decide who is classified as an independent contractor or an employee for a business. If the IRS considers you to be an employee, you need to file Form 8919.

You may also need to file an 8919 if you received both a 1099 and a W-2 from the same business in the same tax year. You can download a copy of IRS 8919 at https://irs.gov/forms-pubs/about-form-8919.

The form a worker needs to file to know whether the IRS views them as an employee or a contractor is Form SS-8. This is the “Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding.”

To complete Form SS-8, you will fill out general information about the business and services performed, how and when the work is done, who pays for expenses, and how you define the relationship between you and the business. IRS From SS-8 and its instructions are available online at https://irs.gov/forms-pubs/about-form-ss-8.

How Do You Know If the IRS Considers You an Independent Contractor or an Employee?

Businesses and individuals file Form SS-8 when they want the IRS to determine who is an employee or independent contractor. Note that although you can complete an SS-8 online, you cannot use e-file software to submit it electronically. It must be printed and mailed or faxed to the IRS office for Form SS-8 Determinations.

Keep in mind that you cannot attach this form to your tax return.

Form SS-8 Mailing Address:

Internal Revenue Service

Form SS-8 Determinations

P.O. Box 630

Stop 631

Holtsville, NY 11742-0630

Form SS-8 Fax Number:

(855) 242-4481

Once the IRS receives Form SS-8, it will use the information provided to determine the status of a worker for tax purposes. They will send a decision by mail.

Questions on an IRS SS-8 are designed to:

- Establish what defines the employer and employee relationship.

- Understand how a worker executes and finishes tasks that their employer hired them to do.

- Verify how the worker is compensated for completing tasks.

What Do You Do with Form 8919 After You Fill It Out?

You can either print and mail Form 8919 (with your tax return) or e-file an 8919 using IRS approved tax prep software.

If you mail the form, you will attach it to your paper return and send it to the IRS filing address for your state based on whether you owe taxes or not: https://irs.gov/filing/where-to-file-addresses-for-taxpayers-and-tax-professionals-filing-form-1040.

Will You Owe the IRS If You Have to File 8919?

In most cases, yes. Workers who discover a business that hired them has misclassified them as an independent contractor will still owe their percentage of back Medicare and Social Security taxes to the IRS.

Remember, those taxes aren’t collected by the IRS until you file a return or pay estimated taxes. So, you will owe them. This is why it is important for a worker who is being treated as an independent contractor but thinks they are an employee to file an 8919 with the IRS as soon as possible.

What Payment Options Do You Have If You Can’t Pay the IRS for Uncollected Social Security and Medicare Taxes?

If the amount of uncollected Medicare and Social Security taxes is more than you can afford, the IRS offers tax relief to help you reduce the amount or pay in monthly installments.

Short-term payment plans allow you to take up to 180 days to pay off your Social Security and Medicare tax debt. Interest and penalties (if applicable) will continue to be added until you pay in full. There is no fee for short-term plans.

If you need more time to pay, an alternative to a short-term payment plan is an installment agreement (IA). With an IA you can make monthly payments to the IRS for up to 72 months.

If paying your back taxes for uncollected Social Security and Medicare tax will make it impossible for you to cover basic living expenses, you may qualify to either have the amount you owe reduced with an Offer in Comprise or have collections paused temporarily with Currently Not Collectible status.

What Is the Difference Between Form 8919 and Form 4137?

Both forms are used to calculate Social Security and Medicare tax, but IRS Form 8919 is for wages and IRS Form 4137 is for unreported tips. Individuals who receive tips must report this income to employers when tips exceed $20 per month.

Workers who did not report tips must pay Social Security and Medicare taxes on this missing income, and Form 4137 determines exactly how much the worker owes for these taxes.

Need more help? You can start online by answering 6 simple questions. You can also call us at 866-568-4593.

6 Simple Questions. Free Evaluation.

Join our Newsletter

Enter your email address to join our free newsletter. Get all the latest news and updates.