IRS Form 2848 allows you to designate another party, such as an attorney or CPA, to represent you in official proceedings with the IRS and to receive confidential information about your taxes. Because your tax information is confidential by law, the IRS cannot discuss it or release it to another person without your express permission. IRS 2848 is the official form to grant this permission.

Here are the answers to Form 2848 questions.

What Is IRS Form 2848?

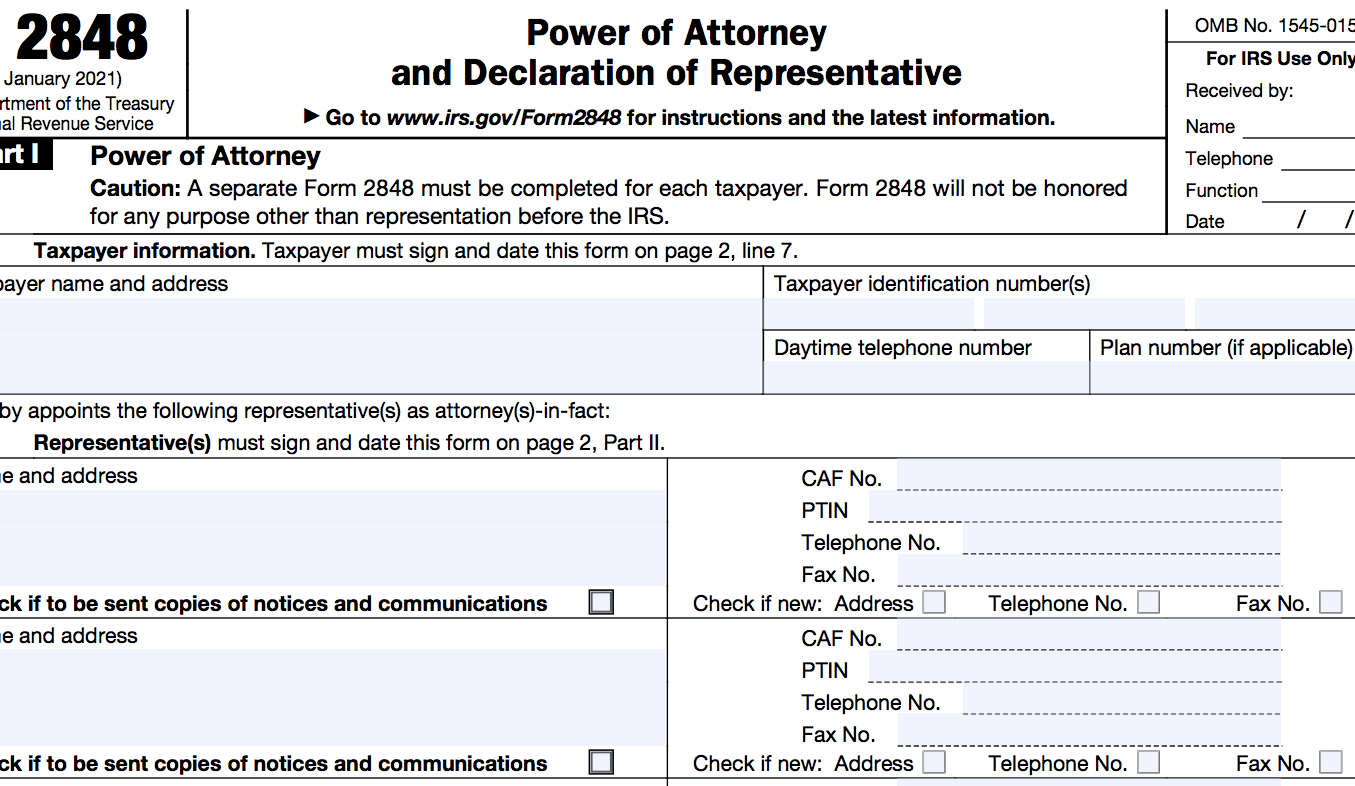

IRS Form 2848 is formally known as Form 2848: Power of Attorney and Declaration of Representative. It is completed and submitted to the IRS to grant permission to a third-party to act on the taxpayer’s behalf by appearing in front of the IRS. A taxpayer may grant this permission when undergoing an audit or facing other types of IRS procedures or hearings.

When Do I Need to File Form 2848?

You need to file IRS Form 2848 when you wish to assign another individual (up to 3 individuals) to act on your behalf in an IRS matter. If you do not complete IRS Form 2848 accurately, the IRS will not work with the other party and will not divulge any confidential information to them, even if you grant permission in another way, such as by certified mail or even in person.

This means that in addition to filling out the other party’s information correctly on Form 2848, you must list the specific tax returns you grant them permission to discuss with the IRS. If, for instance, you list only your tax year 2018 and 2019 returns, and during a proceeding attended by your designated party a matter from tax year 2020 arises, the IRS will not discuss it with them, since it wasn’t included on your form.

Where Can I Find Form 2848?

The easiest way to obtain a copy of IRS Form 2848 is to download it in PDF format from the IRS website. You can also have Form 2848 sent to you by calling the IRS taxpayer service hotline at 800-829-1040 or by calling or visiting your closest local IRS office.

What’s the Form 2848 Fax Number?

The IRS Form 2848 fax number depends on what state you live in. Refer to the table below or https://irs.gov/instructions/i2848 to find the right fax number for your state before you fax your completed Form 2848.

The IRS may change the 2848 fax numbers from time to time, so the IRS recommends that you go to https://IRS.gov/Form2848 and review the “recent developments” section for updates.

2848 Fax Number 1: 855-214-7519

AL, AR, CT, DC, DE, FL, GA, IL, IN, KY, LA, MA, MD, ME, MI, MS, NC, NH, NJ, NY, OH, PA, RI, SC, TN, VA, VT, WV

2848 Fax Number 2: 855-214-7522

AK, AS, CA, CO, HI, ID, IA, KS, MN, MO, MT, NE, NV, NM, ND, OK, OR, SD, TX, UT, WA, WI, WY

2848 Fax Number 3: 855-772-3156

All APO and FPO, American Samoa, CNMI, Guam, the U.S. Virgin Islands or PR

If you live outside the United States, fax Form 2848 to 304-707-9785.

Form 2848 Instructions: How to Fill Out Your 2848

IRS Form 2848 has seven sections plus an area for signatures:

- Section 1 asks for your information, which includes your name, address, taxpayer identification number (TIN) and phone number.

- Section 2 requires you to list the person or persons you authorize to act on your behalf, as well as their address and TIN. Write “none” in the CAF number field if you’ve never authorized this person before. The IRS will assign them a new number.

- Section 3 asks you to list the specific acts or tax returns your designated representative has permission to handle on your behalf.

- Section 4 features a check box indicating that the power of attorney is for a particular use not designated in the CAF. This will remain unchecked for most purposes.

- Section 5 has two sections: one to authorize the representative for additional acts, and one to exclude specific acts from authorization.

- Section 6 allows you to keep a previous power or attorney active by checking a box and attaching a copy of the POA.

- Section 7 requires your signature. Below this section, all representatives you have designated must also sign in order.

How Can Wiztax Help?

Call us today at (866) 568-4593 to learn more about how we can help file a POA on your behalf.

Or start here to take our free online evaluation.

6 Simple Questions. Free Evaluation.

Join our Newsletter

Enter your email address to join our free newsletter. Get all the latest news and updates.