If you are paying $600 or more in mortgage interest, your mortgage lender is obligated to send you an IRS Form 1098 Mortgage Interest Statement. Form 1098 is used to claim a mortgage interest deduction on taxes.

Read on to find out how 1098 Mortgage Interest affects your taxes and how to use Form 1098 to deduct your mortgage interest when you file.

What Is 1098 Mortgage?

Form 1098 is an IRS form used to report mortgage interest paid for a tax year. The mortgage interest form allows lenders to inform the IRS when more than $600 interest has been paid in a year. Individuals also use 1098 to claim mortgage interest deductions when they qualify.

Keep in mind that if your mortgage is less than $600 in interest, points, or mortgage insurance premiums, your lender does not have to provide Form 1098.

How Does 1098 Mortgage Interest Affect Taxes?

In a nutshell, filing Form 1098 Mortgage Interest lowers your tax liability. As mentioned earlier, you can file the 1098 you received from your lender if you want to claim a deduction for the mortgage interest paid.

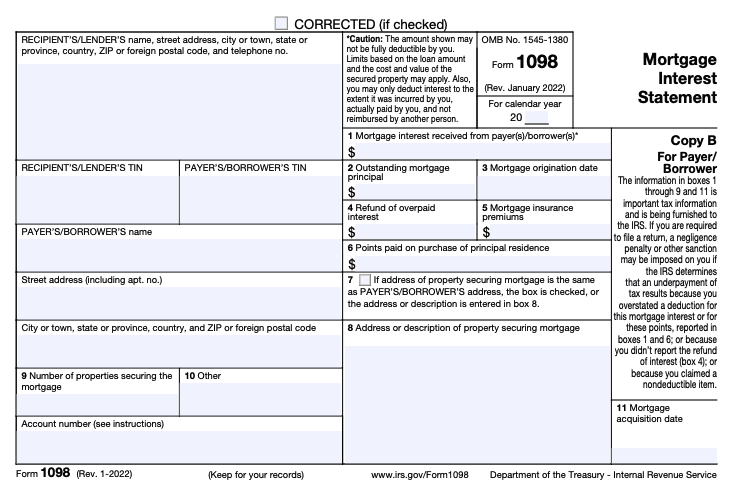

This allows you to reduce your taxable income. Form 1098 has six boxes to be marked or filled accordingly:

- 1098 Box 1: This shows you the total interest you paid without points

- 1098 Box 2: This shows the outstanding mortgage principal

- 1098 Box 3: This indicates the start date of the mortgage

- 1098 Box 4: Here you will find the refund of overpaid interest

- 1098 Box 5: This shows the mortgage insurance premiums you paid in total

- 1098 Box 6: This indicates the value of points you paid

The three most important boxes to check when you are reviewing your 1098 form: Box 1, Box 5, and Box 6. When reviewed together, the amounts shown in these boxes determine the total mortgage interest deduction you are allowed to take.

Who Can File Form 1098 for Mortgage Interest?

The followings are the persons and entities that qualify to file Form 1098 for Mortgage Interest:

- Businesses: As mentioned earlier, businesses that received over $600 in mortgage interest or points from an individual within a year can file Form 1098.

- Individual Mortgage Holders and Sole Proprietors: Individual mortgage holders or sole proprietors can also file Form 1098, provided they paid over $600 in mortgage interest. In this scenario, the individual receives the 1098 tax form from their mortgage lender to file it with their taxes and claim the deduction.

The following are some of the requirements to claim interest deduction using Form 1098:

- The total interest or points that you paid should be $600 or more in a given tax year

- The mortgage should be held by a sole proprietor or an individual

- The mortgage must be secured by real property (i.e., land/structures)

Do You Have to File a 1098 Mortgage Form?

Generally, lenders are obligated to file Form 1098 for each qualifying mortgage. However, since Form 1098 applies only for itemized deductions, individuals do not have to file it unless they wish to claim a deduction for the mortgage interest they have paid.

What Are the Situations When Lenders Don’t Have to File A 1098 Mortgage Form?

Mortgage lenders do not have to file Form 1098 if they received interest payments over $600 from an association, company (that is not a sole proprietorship), corporation, estate, partnership, or trust.

How Do You Fill Out a Mortgage 1098 Form?

The following are the steps to take when filing your Mortgage 1098 Form:

- Gather all 1098 Forms: The first step involves collecting all 1098 forms you need. Since 1098 Forms are included with federal income tax returns, you need to complete these forms before filing your taxes.

- Enter Values on Schedule A of Form 1040: Calculate your mortgage interest, points, and mortgage insurance premiums and enter applicable values accordingly.

- Submit Forms: You can submit your 1098 forms online or by mail.

How to File Multiple 1098 Forms

When filing two or more 1098 tax forms, take note of the following:

- If you have more than one mortgage, file separate 1098 forms for each one

- Include both points and mortgage interest when relevant

- If the total of your mortgage interest and other itemized deductions is less than the standard deduction, it is better to use the standard deduction

What’s the Difference Between Form 1098, 1098-C, 1098-E, and 1098-T?

There are a total of four IRS forms with the 1098 number. These include Form 1098, 1098-C, 1098-E, and 1098-T.

Let’s look at the main differences between these forms:

- Form 1098 (Mortgage Interest Statement): Individuals who paid mortgage interest above $600 use this form to claim tax deductions

- Vehicle Donation 1098-C: This form is used by a tax-exempt organization to claim a deduction for a charitable donation of a vehicle worth over $500.

- Tuition 1098-T: This is the form that you use to claim tuition expenses for post-secondary education.

- Student Loan 1098-E: Individuals who paid student interest above $600 use this form to claim deductions.

6 Simple Questions. Free Evaluation.

Join our Newsletter

Enter your email address to join our free newsletter. Get all the latest news and updates.