Who Earns 1099 Income?

Individuals earning 1099 income have received:

- Over $600 in non-employee compensation (NEC) from a business or individual. Independent contractors and freelancers are the most common type of non-employee receiving payment for performing work.

- Over $600 from third-party payments (PayPal, Venmo, etc.) for goods and services.

- Over $600 in royalties or rent payments.

- Money from fantasy sports, betting/gambling, and lottery winnings; capital gains, dividends, and interest payments from investments.

- Money from Social Security benefits.

Withdrawing funds from a health account saving plan or a 529 college saving plan will also trigger a 1099 tax form.

Do You Include Both W-2 Wages and 1099 Income on Your Tax Return?

Yes. You must add wages/salary and 1099 income before calculating your adjusted gross income (AGI) for taxes. Your AGI determines the tax bracket you are in and how much you owe the IRS for income taxes.

Who Receives IRS Form 1099-K for Payment Card and Third-Party Network Transactions?

Prepaid cards, debit and credit cards, and retail charge cards are types of payment cards. For tax purposes, the IRS is mostly concerned with individuals or companies receiving payments through a third-party network payment card. PayPal, Venmo, and CashApp are examples of popular third-party networks that commonly process payment transactions.

Receiving over $600 for selling your services or goods for a tax year means you will be issued a 1099-K. Anyone receiving money from auction sites, crowdfunding platforms (GoFundMe, Kickstarter, Patreon, etc.), online marketplaces (Amazon, eBay, Etsy, etc.), rideshare apps, and ticket resale sites will also get a 1099-K as long as they earned more than $600.

Who Receives IRS Form 1099-NEC Nonemployee Compensation?

NEC is an acronym for “nonemployee compensation.” Self-employed individuals and independent contractors who were paid more than $600 for performing services for a business will receive a 1099-NEC from that business on or before January 31 for the previous year.

Companies that withhold federal income tax from non-employee compensation must file a 1099-NEC, regardless of how much they paid a non-employee.

Companies that pay freelance or contract workers more than $600 in one tax year will also need to file a 1099-NEC with the IRS.

In addition to money, non-employee compensation can include bonuses, commissions, or other monetary benefits given to the non-employee by a company.

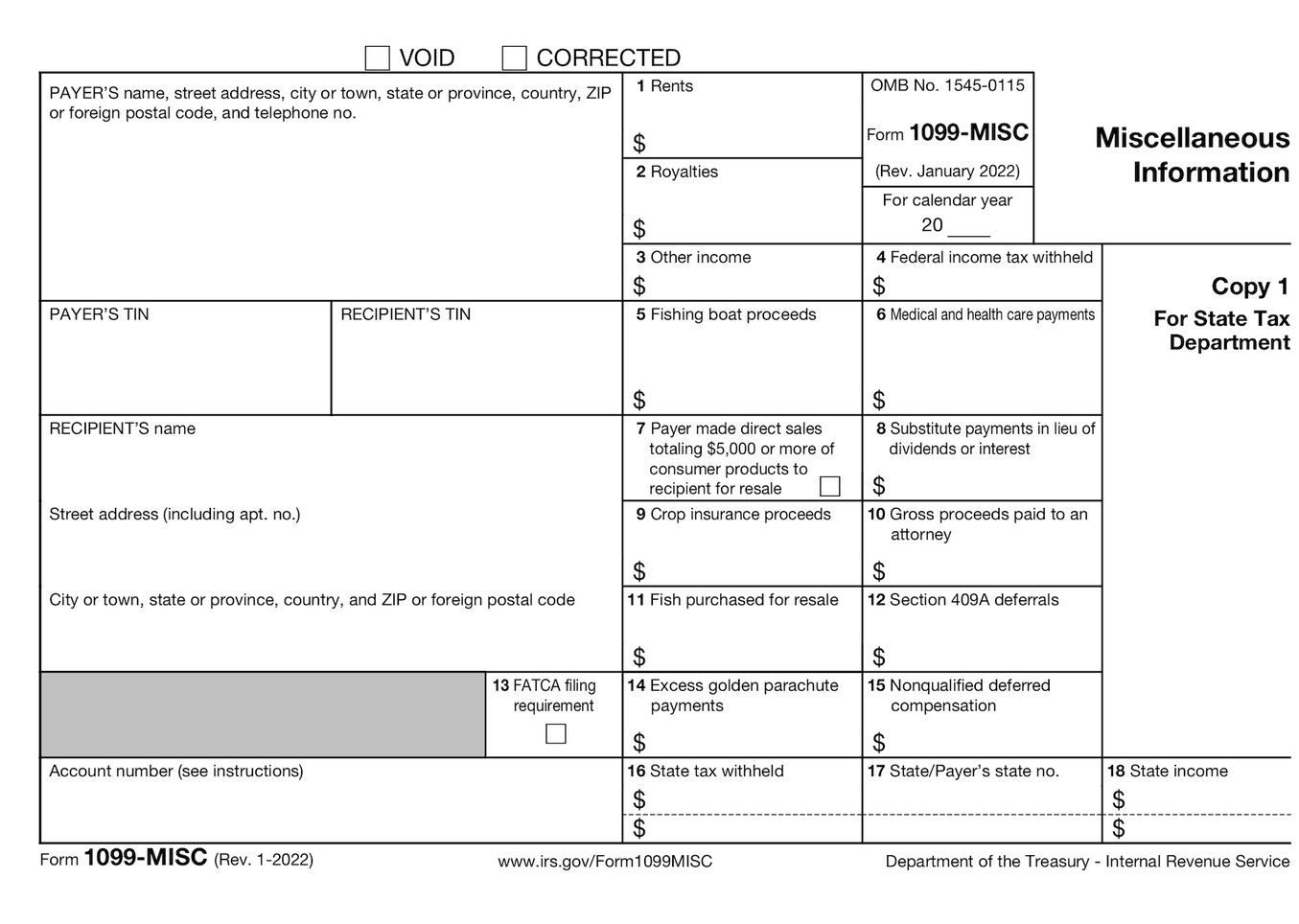

Who Receives IRS Form 1099-MISC for Miscellaneous Income?

You should receive a 1099-MISC if you earned more than $600 in one year from rent, prizes/awards, or health care/medical payments.

Note that prior to 2020, Form 1099-MISC reported payments to freelance workers and other non-employees. Form 1099-NEC is now used to report these payments to the IRS.

If a person makes payments in the process of operating their business, they must fill out and send a 1099-MISC to the IRS indicating the amounts they paid to individuals or businesses during the tax year.

The IRS defines a business as:

- A business operated for profit or gain

- A nonexempt farmers’ cooperative

- Non-profit organizations

- A trust of a profit-sharing plan or a qualified employer retirement pension

- Certain fixed-investment trusts

Can You Receive More Than One Type of 1099 Form in a Single Tax Year?

Yes. You can receive a 1099-K, 1099-NEC, and 1099-MISC in the same year. You may even receive more than one of the same type of 1099 form. For example, you’re an independent contractor working with multiple businesses, you sell goods on both eBay and Etsy, you have a bank CD and earn dividends from investments.

Is All 1099 Income Subject to Self-Employment Tax?

No. Not all 1099 income pays self-employment tax. Some 1099-MISC income, like rent and awards/prizes, isn’t self-employment income. Generally, if you are your own boss, you control your work, you hire/fire employees, and you have contracts with businesses or individuals to do work, expect to pay self-employment tax on your 1099 income for Social Security and Medicare.

What Tax Relief Does the IRS Offer When You Can’t Afford 1099 Income Taxes?

When you can’t afford to pay taxes, whether you have 1099 income, W2 wages, or both, the IRS offers different levels of tax relief depending on how much you owe and your ability to pay.

Tax resolution with the IRS includes short and long-term monthly payment plans, Offer in Compromise (OIC), and Currently Not Collectible status (CNC). Most with 1099 tax debt prefer to request an OIC so they can settle taxes with the IRS for less than what they owe.

How Do You File a 1099 Form?

Companies or single entities that hire independent contractors to perform services must send Copy A for a 1099 Form to the IRS showing how much was paid to the contractor.

Independent contractors should receive Copy B for the same 1099 Form that the company sent to the IRS. Independent contractors do not need to submit Copy B to the IRS since the IRS will already have Copy A for the 1099 Form.

Are There Penalties If You Miss Filing a 1099 Form by the Deadline?

Yes. If you file a 1099 Form within 30 days after the IRS deadline, they will fine you $50. Filing more than 30 days late and before August 1 results in a $100 IRS penalty. Filing after August 1 means paying the IRS a penalty of $260.

Be aware that these penalties apply to individual 1099s. So, the IRS will assess a penalty of $50, $100, or $260 for each 1099 that is late.

Need more help? You can start online by answering 6 simple questions. You can also call us at 866-568-4593.

6 Simple Questions. Free Evaluation.

Join our Newsletter

Enter your email address to join our free newsletter. Get all the latest news and updates.